On-time and on-budget completion have been widely-reported challenges in public infrastructure project development and execution. Many stakeholders argue that 'for profit' risk management methods and perspective can address these challenges.

Public-Private Partnerships (PPP or P3) allow private sector's involvement in delivering public services in partnership with public owners. The private sector participants in a PPP project are expected to be highly skilled in building and operating large infrastructure projects so that the public sector owners can benefit from transferring design, construction and operation risks to their private sector partners under PPP contracts.

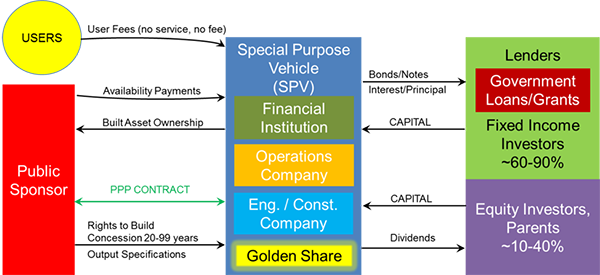

In principle, for an effective public to private sector risk transfer, the private sector partners' combined financing, designing, building and operating capabilities must be superior to those of the public sector sponsor. This superiority is often achieved by multiple private sector companies, each specialized in one or more of these capabilities, partnering and forming a project company called a Special Purpose Vehicle (SPV) to plan, finance, build if necessary and operate the infrastructure asset.

The SPV participation agreement can optimize the overall project risk by allocating each project risk to the party that can influence its outcome most effectively (Arrow, 1974). For example, design and construction risks can be borne by the engineering and construction firms respectively, and operation risks can be borne by the operating firm. In practical applications though the risk/return appetite of each partner greatly influences the allocation basis. For example design firms typically operating in a time and material business model tend to be more risk averse than the construction firms. As a result one rarely sees design firms participating in SPVs as equity partners.

The SPV participation agreement typically allocates the project risk through proportional ownership equity of the SPV. SPV equity allows the participants to receive future profits from the asset. An infrastructure asset is worth considerably more when it is operational than when it is in its planning and construction phases because engineering and construction are arguably the riskiest phases of an infrastructure project. When the construction is complete, the project risk decreases and the asset value increases. Becoming a shareholder of an SPV can improve the gross margin of engineering and construction firms and attract them to high-risk projects as PPP developers.

Various exit, buyout or securitization options tailored for each partner helps improve risk allocation efficiencies. For example if the construction partner does not want to stay as part of an operating company long-term, it can exit through a buyout option in the participation agreement. This option grants them the right to sell their equity share back to the SPV for a certain price after their functional roles in the SPV end. Likewise with the construction firms' exit the proportionate risks borne by the operating and financial firms would increase for the operating and maintenance period. Equity shares in an SPV can be marketed to other investors. Many finance companies that join SPVs have the expertise in packaging and selling SPV equity shares to private and institutional investors such as pension funds, endowments and infrastructure funds (Jacobius, 2009).

The exit options can act as instruments to improve the risk allocation efficiencies by phasing each participant's equity ownership over a time period when they can affect the risk outcomes more effectively. For example construction firms participate and hold an their equity share and can exercise an exit close to sell their shares after construction completion to other partners. This approach would maintain construction firms' risk and return high during the construction phase, decrease or eliminate after the construction is completed.

An SPV also serves as a legal framework for shielding, allocating and controlling financial and project risks. It stands as a separate project company from the parent companies that found and own it and provides them with limited or nonrecourse financing opportunities. Nonrecourse project finance is an arrangement which does not allow lenders and bond investors to go after sponsors' (in this case SPV's parents') assets other than the assets being financed (in this case the SPV) (International Finance Corporation (IFC), 1999). SPV operates, maintains and/or builds the public asset per the public sponsor's specifications and receives compensation for it over the PPP contract period. At the end of the PPP contract period, the SPV is typically dissolved and the asset is turned over to its public sector sponsor/owner.

Project risk allocation by a contract is an effective approach to motivate the participants to perform towards a common goal. A good contract may oblige the parties to perform their roles and bear the associated risks. However, it cannot ensure the project outcome because it cannot guarantee the performance of the participants. Project participants' strong project governance, skillset, experience and capability of managing the allocated risks increase the probability of success.